TKH accelerates transition towards becoming a leading Automation company

Press Release

Haaksbergen, the Netherlands

25 Sept 2025

TKH accelerates transition towards becoming a leading Automation company

Capitalize & Execute 2028 Strategy & Targets

TKH Group N.V. (“TKH”) today announces that it will accelerate its transition towards becoming a leading Automation company to drive further growth and capture value creation opportunities in the asset light Automation activities. Consequently, TKH will evaluate future ownership alternatives for its Electrification activities 1).

During its Capital Markets Day to be held today, TKH will present its ‘Capitalize & Execute 2028’ strategy, with an update on strategy and growth plans in the medium term. During the past years, TKH has created market leading positions based on its proprietary technologies in Automation, which accounts for 60% of TKH’s turnover. Activities are centered around providing high-quality integrated automation machinery and vision technologies, where TKH is well positioned for future growth.

The Electrification segment operates in an attractive market with strong underlying secular trends. With the strategic capex program now completed, the Electrification activities are well positioned to capture the growth driven by the electrification trends and unique proprietary technologies. Given the capital requirements and market dynamics of Electrification, an alternative ownership for the Electrification activities is beneficial.

Alexander van der Lof, CEO of TKH Group: “In the last years of our Accelerate 2025 strategy, we improved our position towards the global trends of Automation and Electrification, on the back of our innovations and R&D roadmap. We believe now is the time to capitalize on our market leading positions by further increasing our focus and enter the next phase for the company.

The future of TKH will be in Automation, where we see many opportunities in long-term value creation based on our unique technologies. We offer innovative, customized, one-stop-shop integrated hardware and software solutions that build long-term customer partnerships, maximize efficiency, and monitor safety. Our strategy for Automation is to be a global market leader by improving customers’ operations and products through state-of-the-art technologies. Following the intended separation of the Electrification activities, a focused Automation business will lead to increased opportunities and unrivalled performance.

TKH’s Electrification business’ is a market leader, focused on electrification of the on- and offshore energy network infrastructure. We have invested significantly in the Electrification activities over the last years. With the completion of our strategic investment program and the operational start-up complexities in the Eemshaven plant largely resolved, the activities are well positioned to capitalize on the realized capacity expansions, with a healthy financial outlook.

We have transformed TKH into two leading businesses with a strong long-term financial outlook, which are well positioned to capture the growth opportunities presented by the automation and electrification trends. For their next phase of growth, TKH is limited to support both activities in their performances and long term capital requirements. Based on the size and asset light structure of Automation, TKH has decided to accelerate its transition towards becoming a leading Automation company. With this TKH expects to maximize shareholder value, taking into account the interests of all stakeholders. TKH expects to make material steps in the separation process in 12 to 18 months, starting with the legal structuring.”

Capitalize & Execute 2028 strategy

With the conclusion of its Accelerate 2025 strategy, TKH is entering its next strategic phase, ‘Capitalize & Execute 2028’. In this next phase, TKH will focus on capitalizing on the realized building blocks in Automation and Electrification. Growth will be realized both by capturing market growth, as well as by growing the addressable markets. Focus will be on execution, in Automation and Electrification, and also on disciplined capital allocation.

Automation

In Automation we strive to be a global market leader, with smart vision and manufacturing technologies, enhancing automation through state-of-the-art AI-integrated technologies. We will continue to grow our total addressable market through new applications that leverage our long-term customer partnerships, our customized one-stop-shop hardware and software offering, and our global scale. Our capex and M&A strategy will be focused on capturing the continued market growth in vision based automation solutions. The operations will be further optimized through integrations, synergies and portfolio rationalizations.

Electrification

The Electrification segment, consisting of on- and offshore activities, benefits from strong underlying secular trends and leading market positions in their respective segments. Our unique technologies, strong sustainability and service offering are evidenced by a strong orderbook. Our strategic capex program, which increased our capacity significantly, will allow the Electrification activities to further capture the market potential. The higher utilization of our offshore inter-array capacity and onshore activities, will lead to significant growth and increased profitability.

Disciplined Capital allocation

In our execution, we will focus on cash flow generation through disciplined capex spending and working capital management. We will continue with the divestment of non-core activities with a total turnover of about €250 million, which includes the earlier communicated divestment of the Digitalization activities. Generated cash, including proceeds from the divestment of non-core activities, will be used for (1) organic capex in our asset-light Automation activities, (2) bolt-on acquisitions in Automation, (3) dividends to shareholders and (4) share buybacks. We aim for a debt leverage ratio of <2.0.

Medium-term targets (2028)

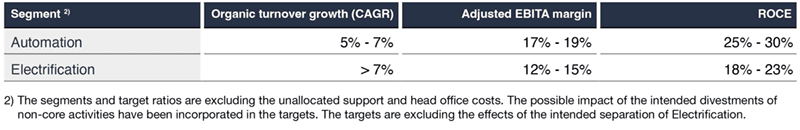

TKH expects to continue its organic growth, with a strict focus on profitability and cash flow conversion.

The following targets for 2028 have been defined:

Capital Markets Day and Webcast

TKH Group N.V. hosts its Capital Markets Day today, at which it will present and discuss its strategy update and targets. You can watch the event via live webcast at 14:00 CET www.tkhgroup.com. Afterwards, the webcast and the presentations will be made available on TKH’s website.

Haaksbergen, September 25, 2025

1) The Electrification activities consist of the Electrification segment excluding Digitalization and the intended divestments of non-core activities.