Dividend financial year 2014

Press Release

Haaksbergen, the Netherlands

8 May 2015

Dividend financial year 2014

The Annual General Meeting of Shareholders of 7 May 2015 has decided to set the dividend for the financial year 2014 as follows:

€ 0.05 per priority share with a nominal value of € 1.00;

€ 1.00 per (depositary receipt of an) ordinary share with a nominal value of € 0.25.

Shareholders, or alternatively holders of depository receipts, may opt to have the dividend paid in full in cash (subject to withholding of the dividend tax owed) or as shares or depository receipts of shares. The stock dividend, in the form of shares or depository receipts of shares, will be determined after expiry of the option period on the basis of the average share price during the last five days of trading of the option period, which will end on 27 May 2015. No trade in dividend rights will take place on Euronext in Amsterdam (“Euronext”). The new (depositary receipts of) ordinary shares with a nominal value of € 0.25 are fully authorised for the dividend for the financial year 2015 and subsequent years.

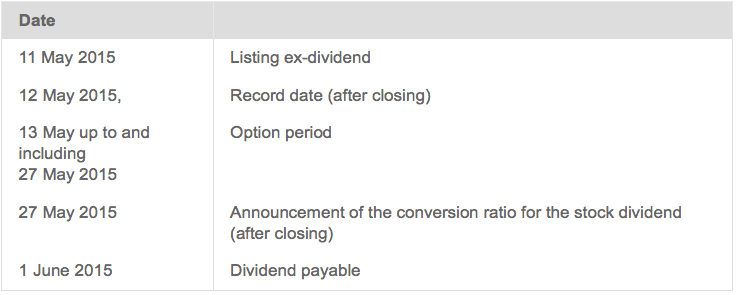

The following timetable applies to the dividend for 2014.

Shareholders of (depositary receipts of) ordinary shares should communicate their option to ABN AMRO Bank NV ('ABN AMRO') in the afore¬mentioned option period via their bank or broker. In general, if your (depositary receipts of) ordinary shares are held by a bank or broker, the bank or broker in question will automatically give notice that the dividend should be paid as a stock dividend in the form of (depositary receipts of) ordinary shares, unless you have stipulated otherwise. The dividend rights relating to your option must be delivered directly to ABN AMRO at the latest by 15:00 hours CEST on 27 May 2015 in favour of account 28001/106. If the option is not exercised, the dividend will be paid in cash to holders of (depositary receipts of) ordinary shares, subject to withholding of the dividend tax owed.

The payment of the dividend and the transfer of (depositary receipts of) ordinary shares in relation to the conversion of dividend rights will take place from 1 June 2015 onwards. Delivery of depositary receipts of shares to your bank or broker will only occur on the basis of the total number of dividend rights delivered on 27 May 2015, whereby the remaining fraction will be settled in cash on the basis of the opening share price on 28 May 2015 and in accordance with the conditions of the bank that holds your shares.

In accordance with section 5:3 (2) (d) of the Financial Supervision Act (Wet op het financieel toezicht, “Wft”) there is (in brief) no obligation to publish a prospectus in relation to the offer of shares which are issued as a dividend, on condition that a document is published which contains the necessary data. In so far as the share option qualifies as a general offer of shares, this notice serves as such a document. In addition (in brief), in accordance with section 5:4(e) of the Financial Supervision Act, there is no obligation to publish a prospectus in relation to the admission to trade on a market (Euronext) situated and regulated in the Netherlands of shares which are paid out as dividend, on condition that a document is published which contains the necessary data. In respect of the admission to trade, this notice serves as such a document.

Shareholders who are registered in the company’s register of shareholders will be informed directly by the company.

Executive Board TKH Group NV

Stichting Administratiekantoor TKH Group

Haaksbergen, 8 May 2015