Full year 2016 Results

Press Release

Haaksbergen, the Netherlands

7 Mar 2017

TKH ends 2016 with good fourth quarter

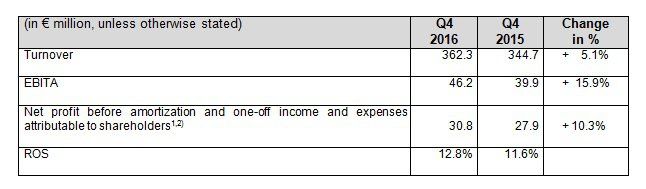

Highlights Q4

- Turnover up 5.1% at € 362.3 million, organic turnover growth 4.8%.

- Turnover Building Solutions and Industrial Solutions up 4.5% and 7.6% respectively, turnover decline of 1.7% at Telecom Solutions.

- Increase in EBITA of 15.9%, mainly driven by rise in EBITA Industrial Solutions due to increase in production volume.

- Healthy mix in activities and high turnover level results in ROS of 12.8%.

- Increase in net profit before amortization and one-off income and expenses of 10.3%.

- Visible recovery in order intake in tire building segment (Industrial Solutions) to € 89 million in Q4.

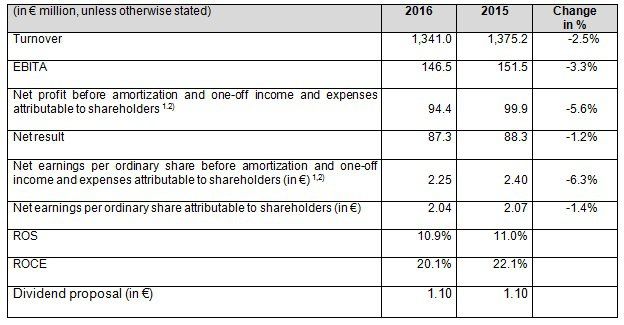

Highlights 2016

- Decline in turnover of 2.5% to € 1,341.0 million, organic turnover decline of 0.8%.

- Decline in EBITA of 3.3% due to lower production volumes at Industrial Solutions in the first nine months.

- Increase investments and R&D spending to strengthen technology base and further expand TKH’s leading position.

- Decline in net profit before amortization and one-off income and expenses attributable to shareholders of 5.6% to € 94.4 million; slightly above the previously communicated bandwidth (€ 88 - € 93 million).

- Robust ROS of 10.9% and ROCE of 20.1%.

- The share of innovations in turnover was 19.0%, well above the target of 15%.

- Dividend proposal: € 1.10 per (depository receipt for an) ordinary share, equal to the dividend for 2015.

1) Amortization of intangible fixed assets related to acquisitions (after tax).

2) The one-off income and expenses in 2016 were impairments, on balance, of € 0.2 million (2015: €1.5 million) and tax income of € 3.0 million (2015: € 0.3 million). In Q4 2016, this amounted to, on balance, income of € 2.9 million (Q4 2015: € 0.8 million expense).

Alexander van der Lof, CEO of technology company TKH:

"We were able to close the year 2016 with a good fourth quarter, in which we saw a recovery of both turnover and order intake at Industrial Solutions, in particular in the sub-segment manufacturing systems. Thanks to preparations we had made in the preceding quarters in terms of the organization of the production capacity, we were able to realize the higher production volumes efficiently. Although order intake in China remains low, the order intake from the top five tire manufacturers increased in the fourth quarter. In Building Solutions, important steps were taken in preparation for the targeted growth in our vertical growth markets. We will start production on the first of our larger order in the new plant for subsea connectivity in the second quarter of 2017. In Machine Vision, we made a breakthrough with distinctive 3D technology for producers of consumer electronics of which we made the first deliveries in the fourth quarter. Higher R&D spending had a slightly negative impact on the ROS, but create a good perspective for the realization of the growth in our vertical growth markets."

Dividend proposal

At the Annual General Meeting to be held on 3 May 2017, TKH will propose the payment of a dividend of € 1.10 per (depositary receipt for a) share (2015: € 1.10). Based on the number of outstanding shares at year-end 2016, this amounts to a pay-out ratio of 49.2% of the net profit before amortization and one-off income and expenses attributable to shareholders and 53.1% of the net profit. TKH will propose the payment of a cash dividend to be charged to the reserves. The dividend will be payable on 10 May 2017.

Outlook

The global economic outlook is generally positive. At the same time, uncertainties such as the geopolitical developments, the economic developments in China and low oil prices continue to have a negative impact on the willingness to invest in certain sectors. In order to respond to the market developments, we decided in the course of 2016 to further increase our R&D efforts and focus on acceleration of the growth programs within our vertical growth markets. This has created a strong foundation to safeguard our growth ambitions for the coming years.

Based on the implementation of our growth plans, together with the defined building blocks for growth and associated roll-out of new technology, we see a better starting position for growth in 2017 compared to a year ago. The expectation is that growth will materialize from 2018. The steps taken in 2016, provides confidence that we are on the right track. This creates a solid basis for our expectation to again increase turnover in the defined seven vertical growth markets of € 300 million and € 500 million in the coming three to five years.

Barring unforeseen circumstances, we expect the following developments for the year 2017:

Telecom Solutions

We expect a further increase in investments in optical fibre networks in Europe and China. Due to our investments in market penetration within Europe in recent years, TKH’s growth potential will be focused primarily on Europe. The scarcity of optical fibre in the Chinese market will decline in the course of 2017, which may result in pressure on margins.

Building Solutions

We expect the reluctance to invest in the oil and gas industry to continue. At the same time, we do see growth in the Marine & Offshore segment given the start of our subsea cable systems activities. In addition, the technological developments in the Machine Vision portfolio will enable TKH to further expand its market share with advanced technology.

Industrial Solutions

Investments in the industrial sector combined with robotization and automation are increasing, which means we expect to be able to realize growth in the sub-segment industrial connectivity systems. There is continuing reluctance to invest in China in the sub-segment manufacturing systems, but we see a large number of projects outside China that we expect to come to realization in the coming year. The order book at the start of 2017 is filled better than it was a year earlier, and on balance, we expect higher order intake in 2017 compared to last year.

As usual, TKH will give a concrete outlook for the full-year 2017 profit at the presentation of its interim results in August 2017.

The complete press release can be downloaded in PDF