H1 2021 Results

Press Release

Haaksbergen, the Netherlands

17 Aug 2021

Strong turnover growth in second quarter leads to 37.5% increase in net profit over H1 2021 Strong increase in order intake and order book

Highlights second quarter 2021

- All Solutions contributed to strong turnover growth (up 18.5%, organic growth 16.8%) and an increase in EBITA before one-off income and expenses of 52.8%.

- High demand and innovations lead to strong increase in order intake and order book in all Solutions.

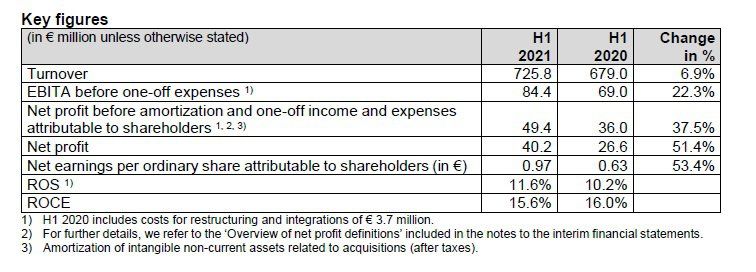

Financial highlights first half 2021

- Turnover up 6.9% at € 726 million, organic growth 5.8%.

- Strong turnover growth at Telecom and Building Solutions offsets decline at Industrial Solutions.

- EBITA before one-off income and expenses 22.3% higher at € 84.4 million.

- ROS up at 11.6% (H1 2020: 10.2%), with strong recovery in Q2.

- Net profit before amortization and one-off income and expenses attributable to shareholders increased by 37.5% to € 49.4 million.

- Order book increased by 49% (€ 211 million) to € 639 million per 30 June 2021.

Strategic highlights first half 2021

- Demand further increased with high level of activity in almost all markets.

- Impact of supply chain challenges well managed, resulting in an only limited effect on activities.

- Solid progress strategic development, driven by ‘Simplify & Accelerate’ program:

- Focus on margin improvement well on track.

- Divestment program on track to be finalized within 12 months. - Increased order intake with good contribution from innovations, such as subsea connectivity systems, 3D confocal vision technology, tire building systems and Indivion.

Outlook

The improved market circumstances, combined with the increasing demand and strong order book, leads to a positive outlook for the full year. Supply chain challenges can have an impact on some of TKH’s operations in the second half of 2021. Forecast full year 2021: net profit from continued operations before amortization and one-off income and expenses attributable to shareholders to increase significantly to between € 106 million and € 112 million, compared to € 70.3 million over 2020.

Alexander van der Lof, CEO of technology company TKH: “In this first half year we have seen a strong increase in demand for almost all of our activities, resulting in a very high order intake of € 937 million (H1 2020: € 668 million) and an increase in order book of 49%. Order intake grew especially in tire building, machine vision, energy connectivity systems (including subsea) and specialized connectivity systems.

With the more focused strategic direction, our strong innovative power and a large number of new contracts signed, we are well positioned to boost our performance amidst the post-COVID-19 recovery. The ‘Simplify & Accelerate’ program, as introduced in 2019, is on track, and we expect to finalize our divestment program within the next twelve months. The share buyback program of the first quarter of this year underlines our strong financial position.

The realization of a ROS of 13.4% in the second quarter shows that TKH makes good progress towards the ROS-target of 15%. Our business fundamentals provide a strong basis for organic growth and value creation.”

Financial developments first half

The turnover in the first half of the year increased with € 46.9 million (6.9%) to € 725.8 million (H1 2020: € 679.0 million). Higher raw materials prices had an upward impact of 2.6% on turnover, while exchange rates had a negative impact of 1.2%. Divestments had a downward impact of 0.3%. On balance, TKH recorded a 5.8% organic growth in turnover.

The gross margin decreased to 48.2% (H1 2020: 49.0%) due to a shift in product mix with a larger share in connectivity combined with an increase in raw material prices.

Operating expenses increased by 0.6% compared with the first half of 2020. As a percentage of turnover, operating expenses decreased to 36.6% in the first half of 2021, from 38.8% in the first half of 2020. The implemented integrations and cost savings accounted for a significant share of the relative reduction of costs. At the same time, selling expenses were still at a lower level due to the COVID-19 restrictions. Depreciation came in at € 22.1 million, € 0.8 million below the level in the first half of 2020, mainly due to a lower depreciation on the right-of-use assets.

The operating result before amortization of intangible assets and one-off income and expenses (EBITA) increased by 22.3% to € 84.4 million in the first half of 2021, from € 69.0 million in the first half of 2020. All Solutions contributed to the increase, with the EBITA in Telecom, Building and Industrial Solutions increasing by 17.1%, 32.0% and 3.3% respectively.

ROS increased to 11.6% in the first half of 2021 (H1 2020: 10.2%) due to the turnover growth and a lower relative cost level, with a very strong recovery in Q2. ROS increased in all three Solution segments.

Amortization decreased, as the amortization on certain PPA’s from past acquisitions have ended.

The financial result declined by € 2.3 million, mainly because in the first half of 2020 a profit of € 5.5 million on divestments was included. In H1 2021, foreign exchange results and results from associates improved.

The normalized effective tax rate increased to 27.1% in the first half of 2021, from 26.2% in the first half of 2020, primarily due to higher profits at companies that are charged at higher tax rates.

Net profit from continued operations before amortization and one-off income and expenses attributable to shareholders increased by 37.5% to € 49.4 million (H1 2020: € 36.0 million). Net profit increased by 51.4% to € 40.2 million (H1 2020: € 26.6 million).

Net debt, calculated in accordance with the bank covenants, increased compared to year-end 2020 by € 13 million to € 275 million. The increase is mainly related to dividends paid combined with the share buyback program. This was offset partly by the positive results and a decrease in working capital. On 30 June 2021, working capital as a percentage of turnover was at 11.2%, lower than on 30 June 2020 (16.6%). Last year, the percentage increased due to the postponement of the delivery of various projects within Industrial Solutions. This effect has phased out. Prepayments on the high order intake in Industrial Solutions and some temporary deferral of vat and wage tax payments lowered working capital.

The Net debt/EBITDA ratio stood at 1.5 at end-June 2021, well within the financial ratio agreed with the banks. Solvency amounted to 40.3% (H1 2020: 40.5%).

The number of permanent employees (FTEs) stood at 5,647 at 30 June 2021 (end 2020: 5,583 FTEs). In addition, TKH had 304 temporary employees at 30 June 2021 (end 2020: 121).

Developments per Solution segment

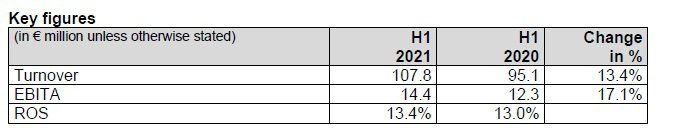

Telecom Solutions

Telecom Solutions encompasses the core technologies connectivity and vision & security. TKH develops, produces, and supplies systems ranging from basic outdoor infrastructure for telecom and CATV networks through to indoor home networking applications. Around 40% of the portfolio consists of optical fibre and copper cable for hub-to-hub connectivity. The remaining 60%, consisting of components and systems in the field of connectivity and peripherals, is deployed primarily in network hubs – share in turnover 15%.

Turnover in the Telecom Solutions segment increased by 13.4% to € 107.8 million. Currency exchange rates had a negative effect of 0.6%. Turnover increased organically by 14.0%.

EBITA was up 17.1% at € 14.4 million. ROS increased to 13.4% in the first half of 2021 (H1 2020: 13.0%).

Fibre Optic Networks – Turnover increased due to high investment priority for fibre networks in Europe and less negative impact from lockdowns on the clients’ installation capacity. Particularly in France, a strong recovery was realized. The overcapacity in the Chinese market had a slight negative effect on the added value, which was offset by a higher share of our connectivity system portfolio.

Other markets – Growth was realized within the broadband portfolio for home offices.

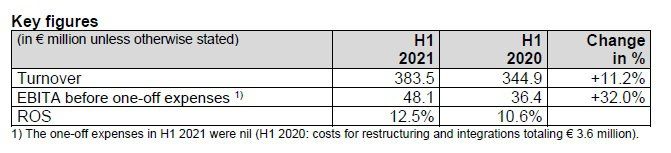

Building Solutions

Building Solutions connects the core technologies vision & security and connectivity in integrated solutions in and around buildings, infrastructure, as well as machine vision for inspection, quality, product and process controls. We provide solutions focused on efficiency, safety & security and sustainability for a number of specific sectors, including machine vision, healthcare, parking, marine & offshore and infrastructure – turnover share 53%.

Turnover in the Building Solutions segment increased by 11.2% to € 383.5 million. Higher raw material prices had an upward impact of 4.4% on turnover. Divestments in 2020 reduced turnover by 0.6%. Currency effects had a downward effect of 2.1% on turnover. On balance, turnover increased organically by 9.4% in the first half of the year.

EBITA increased by 32.0% to € 48.1 million, mainly due to strong growth in Machine Vision and connectivity systems. This resulted in an increase in ROS to 12.5% in the first half of the year (H1 2020: 10.6%).

Machine Vision – There was a strong increase in turnover and order intake in the consumer electronic market segment. Also, factory automation, logistics, automotive and wood sector showed further growth. Challenges in the supply chain had a limited impact on the business.

Infrastructure – The demand for Airfield Ground Lighting (CEDD/AGL) was clearly impacted by COVID-19, as a result of investment limitations at airports. However, the sales funnel for 2022 is promising. The low order intake at airports was largely offset by a good development in the demand for energy connectivity systems. TKH is expanding its production capacity for energy cable systems and expects this to become operational during the third quarter of 2021. In traffic monitoring systems, an increase in turnover was realized.

Marine & Offshore – Increase in turnover, which in particular benefited from the subsea cable activities where production utilization increased further. A new contract was won for the supply of 140 km 66 kV inter array cables for Hollandse Kust Noord. The prospect for new orders is further improving due to strong market growth for alternative energy sources.

Parking – The low investment level within this market, in particular at shopping malls and airports, continued due to low capacity utilization in parking garages as a result of COVID-19.

Care - Demand for our communications technology for care alerts and elderly care increased. There was a less negative effect of lockdowns on the installation opportunities in care institutions.

Other markets – Demand in the building & construction market increased. Especially in France and Germany, our connectivity solutions recorded a substantial growth.

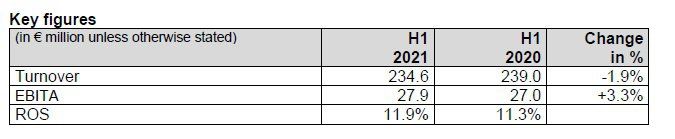

Industrial Solutions

Industrial Solutions encompasses the core technologies connectivity, vision & security and smart manufacturing. TKH develops, produces and delivers specialty cable and plug and play cable systems. TKH’s know-how in the automation of production processes and improvements in the reliability of production systems gives the company the differentiating potential it needs to deliver innovative, integrated production systems in a number of specialized industrial sectors, such as tire manufacturing, robot, medical and machine-building industries - turnover share 32%.

Turnover in the Industrial Solutions segment fell by 1.9% to € 234.6 million. Higher average raw material prices had a positive impact of 1.0%. Exchange rates had a negative effect of 0.2%. Organically, turnover fell by 2.7%.

EBITA was up 3.3% at € 27.9 million. ROS increased to 11.9% in the first half of 2021, from 11.3% in the first half of 2020. There was a strong improvement of EBITA and ROS from Q1 to Q2.

Tire Building – While turnover in Q1 was significantly impacted by the effects of the low order intake in Q2 and Q3 2020, a strong recovery of the order intake in the past quarters translated in a higher turnover and result in Q2. The order intake from Asian customers recovered well, and the intake from the top-five tire manufacturers is increasing. At 30 June, the order book is at a high level. The development of the UNIXX (a new tire-building platform) is progressing well, with completion delayed due to COVID-19 and now expected by the end of this year.

Care – Turnover is gradually growing, driven by the breakthrough of the Indivion technology. The service organization in North America is being ramped-up to support further growth in this region. Our specialized connectivity systems for medical equipment showed a good recovery.

Other markets – There was a substantial growth in connectivity systems for the machine building and robotics industry.

Outlook

The improved market circumstances for our solutions, as well as our capability to increase our manufacturing capacity utilization, lead to a positive outlook for the second half year. Based on these developments, we anticipate a further organic growth of turnover and result in the second half of 2021. The impact of supply chain challenges, which was limited to date, may increase for the second half of 2021 for some activities.

In our Telecom Solutions, which had a strong first half, we expect turnover and EBITA in the second half of the year to be comparable to the first half of 2021. Fibre Optic Networks will remain a driver of turnover with a continuing high investment priority in Europe, where we expect less negative impact from lockdowns on the installation capacity. Price levels for fibre optics are expected to improve gradually.

Within Building Solutions, turnover and EBITA in the second half year of 2021 are expected to increase compared to the first half year of 2021. We will see a lower turnover in 3D machine vision, due to seasonality and supply chain shortages, which will be offset by growth in security systems, energy connectivity systems (Infrastructure), subsea (Marine & Offshore) and 2D machine vision.

In Industrial Solutions, turnover and EBITA are expected to show a strong growth in the second half year 2021, compared to the first half year, driven by the high order intake in Tire Building in the past quarters. The expected ROS improvement is driven by volume effects and cost control.

On balance and barring unforeseen circumstances, for the full year 2021 TKH expects net profit from continued activities before amortization and one-off income and expenses attributable to shareholders to increase significantly to between € 106 million and € 112 million (2020: € 70.3 million).

The complete press release can be downloaded in PDF