H2 2021 and Full year 2021 Results

Press Release

Haaksbergen, the Netherlands

8 Mar 2022

Substantial organic growth in turnover and results

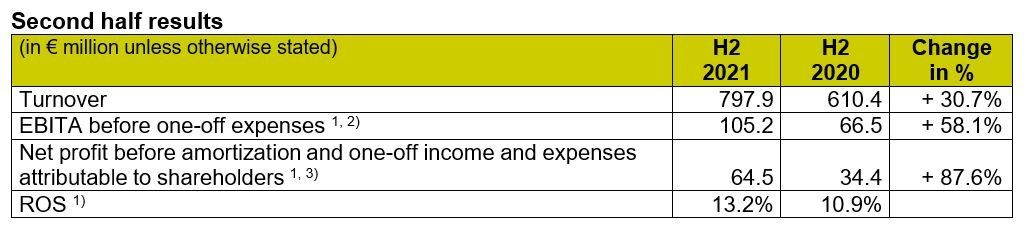

Financial highlights second half 2021

- Order intake in Q4 of € 512 million (Q4 2020: € 370 million) – Growth achieved in all segments.

- Turnover in H2 2021 increased by 30.7% to € 797.9 million, organic 27.5%.

- EBITA before one-off income and expenses increased by 58.1% to € 105.2 million, driven by higher turnover and cost efficiencies.

- ROS increases to 13.2% (H2 2020: 10.9%).

- Net profit before amortization and one-off income and expenses attributable to shareholders improved by 87.6% to € 64.5 million.

- Cash flow from operating activities was € 109.7 million (H2 2020: € 150.1 million and H1 2021: € 89.3 million) - driven by working capital improvement Q4.

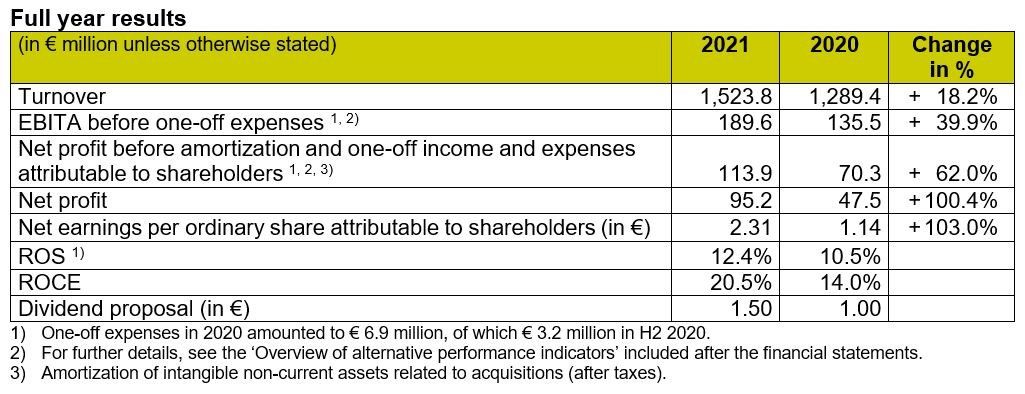

Financial highlights 2021

- Order book increased by 74.3% (€ 318.2 million) to € 746.6 million per year-end as a result of record high order intake of € 1,842 million (2020: € 1,294 million).

- Turnover up 18.2% at € 1,523.8 million, organic growth 15.9%.

- EBITA before one-off income and expenses 39.9% higher at € 189.6 million – Strong increase in all segments.

- ROS up to 12.4% (2020: 10.5%).

- Net profit before amortization and one-off income and expenses attributable to shareholders increased by 62.0% to € 113.9 million – Above the previously communicated bandwidth (€ 106 - € 112 million).

- Strong financial position at year-end – Net debt / EBITDA ratio 0.9.

- Dividend proposal: € 1.50 per (depositary receipt for) ordinary share (2020: € 1.00).

Strategic highlights 2021

Alexander van der Lof, CEO of technology company TKH: "As we publish our results today, we are proud to show such strong growth and a record high order intake of € 1,842 million. At the same time though, our thoughts go out to all people in Ukraine, and in particular our 128 employees and their families in the area of Kiev. We are deeply concerned about the war and we are monitoring the situation carefully. We will support them across our organization as much as possible in this difficult and uncertain time.

Looking back at 2021, the demand for all our technologies and innovations has strongly recovered. We have proven to possess the capabilities and entrepreneurship within our organization to cope with the exceptional increase in demand in a very short period, despite the supply-chain challenges, COVID-19 restrictions, and limits on the availability of workforce.

As a result of our Simplify & Accelerate program, TKH has transformed into a streamlined and focused technology company. This has led to a new segmentation based on our three Smart Technologies, making our performance more transparent. We launched the Accelerate 2025 program at the Capital Markets Day on 17 November with new targets for 2025, giving us a strong foundation for value creation in the coming years. In addition, we decided to increase our focus on, and commitment to, ESG and sustainability.

We are well-positioned to benefit strongly from megatrends like the energy transition, digitalization and industrial automation. To respond to the high market demand, we have decided to prepare for an expansion of our production capacity and additional capital investments in 2022 and 2023. Furthermore, by increasing our focus on Smart Technologies with more intelligent software, we can take advantage of the expected market growth and unlock the full potential of our disruptive technologies, leading to a ROS of over 17% over the medium term."

General developments

Simplification

After the successful implementation of the Simplify & Accelerate program (introduced in 2019), strongly focused on activities with higher ROS and organic growth, TKH has made significant steps to transform the organization and increase its focus on value creation during 2021. With several divestments, integrations, innovations, and acquisitions financial performance was further increased. The ROS of 13.2% in the second half year of 2021 (H2 2020: 10.9%) showed that TKH made good progress towards the ROS target.

As part of its simplification, TKH has changed to new reporting segments: Smart Vision systems, Smart Manufacturing systems, and Smart Connectivity systems. The new segmentation reporting will provide more transparency and perspective on the potential of our value creation in the coming years. To enable comparison, the previous segmentation is disclosed in the notes to financial statements.

Accelerate 2025

On the Capital Markets Day in November 2021, we launched our new program Accelerate 2025, which aims to increase our turnover to more than € 2 billion and a ROS of >17% by 2025. This will be realized by unlocking the full potential of our innovations and disruptive technologies. Benefitting from megatrends such as energy transition, digitalization, industrial automation and safety and security, we will be able to take full advantage of the expected market growth.

Investments & divestments

To respond to the high market demand related to the megatrends, we have decided to prepare for an expansion of our production capacity and additional capital investments in 2022 and 2023. As part of Accelerate 2025, we expect to acquire around € 100 - € 150 million in turnover during the coming years. A further € 150 - € 200 million of turnover will be divested, as we continue to reduce activities with lower margin and growth potential. Preparations have started in 2021.

Impact of COVID-19

COVID-19 continued to have an impact on operations and financial performance in 2021. Following a slow start in the first quarter of 2021, due to the ongoing COVID-19 restrictions in several countries, we saw a strong recovery in most markets. The airport and parking industries investments were still postponed. During the year, COVID-19 restrictions caused operational challenges in commissioning equipment at customer sites. Also, our absence rate was higher than usual due to quarantine regulations and other precautions. However, despite these challenges and limitations, the organization was able to adapt very well.

Financial developments second half of 2021

Turnover was up with € 187.5 million (30.7%), leading to a total of € 797.9 million in the second half of 2021 (H2 2020: € 610.4 million). Higher raw materials prices had an upward impact of 2.7% on turnover, while higher exchange rates contributed 0.5%. On balance, TKH recorded a 27.5% organic growth in turnover. All three segments contributed to the organic growth in turnover, but Smart Manufacturing systems was the highest contributor with an organic growth of 51.8%, largely driven by the recovery in the tire building industry.

The gross margin decreased to 48.5% (H2 2020: 49.4%) due to increased raw material and component prices and a shift in product mix with a lower share in Smart Vision systems.

The operating result before amortization of intangible assets and one-off income and expenses (EBITA) increased by 58.1% to € 105.2 million in the second half of 2021 (H2 2020: € 66.5 million). All segments contributed to the increase in EBITA; Smart Vision systems contributed with +20.7%, Smart Manufacturing systems with +135.7%, and Smart Connectivity systems with +48.2%, respectively. The ROS improved to 13.2% (H2 2020: 10.9%) due to turnover growth and a lower relative cost level.

The financial result improved by € 2.3 million, largely due to a higher result from associates that benefited from the recovered market demand.

The normalized effective tax rate increased to 25.6% in the second half of 2021 compared to last year (H2 2020: 24.7%).

Net profit before amortization and one-off income and expenses attributable to shareholders increased by 87.6% to € 64.5 million (H2 2020: € 34.4 million).

Financial developments full year 2021

The recovery of the order intake, which already started in the fourth quarter of 2020, continued during 2021. We realized a high order intake of € 1,842 million (2020: € 1,294 million) on the back of a strong increase in demand for almost all our activities, leading to an order book at year-end of € 746.6 million, an increase of 74.3% compared to last year. Particularly, significant growth in order intake was realized in Machine Vision (Smart Vision systems), Tire Building (Smart Manufacturing systems), energy and digitalization (Smart Connectivity systems).

Turnover increased with € 234.4 million (18.2%) to € 1,523.8 million in 2021 (2020: € 1,289.4 million). Higher raw material prices had an upward impact of 2.6% on turnover, while exchange rates had a negative impact of 0.1%. Divestments had a downward impact of 0.2%. On balance, TKH recorded a 15.9% organic growth in turnover. All segments contributed to the organic growth in turnover. The supply-chain challenges in the availability and transportation of raw materials and components had a negative impact of about € 20 – € 30 million on our turnover in 2021, although our procurement teams managed to find solutions for the majority of issues. We responded to these challenges by increasing our stock levels and ensuring a larger supply of replacements for components, redesigning some of our products, and contracting alternative suppliers. Our pricing power enabled us to pass on most of the resulting price increases.

The geographic distribution of turnover remained mostly in line with 2020. The turnover share in the Netherlands decreased to a level of 22% of total turnover (2020: 24%), whereas the turnover share in Europe, excluding the Netherlands, increased to 45% (2020: 43%). The turnover share in Asia remained unchanged at 19%, North America decreased to 11%. The turnover share of the other geographic areas was 3%.

The gross margin decreased to 48.3% in 2021 (2020: 49.2%) due to a shift in product mix, with a larger share in Smart Connectivity systems combined with increased raw material and component prices.

Operating expenses (excluding amortization and impairments) increased by 9.6% compared with last year. As a percentage of turnover, operating expenses decreased to 35.9% in 2021, from 38.7% in 2020. The implemented integrations and cost savings accounted for a significant share of the relative reduction of costs, in combination with higher productivity and capacity utilization in TKH’s production companies. At the same time, selling expenses were still low due to the ongoing COVID-19 restrictions. Depreciation came in at € 45.2 million, € 0.3 million below the level of 2020, mainly due to a lower depreciation on the right-of-use assets.

The operating result before amortization of intangible assets and one-off income and expenses (EBITA) increased by 39.9% to € 189.6 million in 2021, from € 135.5 million in 2020. All segments contributed to the increase in EBITA; Smart Vision systems contributed with +18.9%, Smart Manufacturing systems with +43.5%, and Smart Connectivity systems with +61.9%, respectively. The ROS improved to 12.4% (2020: 10.5%) due to the turnover growth and a lower relative cost level. ROS increased in all three segments.

Amortization decreased as the amortization on certain purchase price allocations related to past acquisitions has ended.

The financial result remained stable at € 8.0 million (in expense). In 2020, a profit of € 5.5 million on divestments was included. In 2021, foreign exchange results and results from associates improved, while interest expenses were lower.

The normalized effective tax rate increased to 26.2% in 2021, from 25.4% in 2020, primarily due to increased profits at companies that are subject to higher tax rates.

Net profit before amortization and one-off income and expenses attributable to shareholders increased by 62.0% to € 113.9 million (2020: € 70.3 million). Net profit rose by 100.4% to € 95.2 million (2020: € 47.5 million). Earnings per share before amortization and one-off income and expenses amounted to € 2.77 (2020: € 1.69). Ordinary earnings per share were € 2.31 (2020: € 1.14).

The cash flow from operating activities amounted to € 199.0 million in 2021 (2020: € 187.8 million). In 2020, the cash flow was boosted by a decline in working capital, while there was little change in 2021. At year-end 2021, working capital fell as a percentage of turnover to 10.1% (2020: 12.1%) and therefore ended below the bandwidth target of 12–15%. The cash flow from net investments in property, plant, and equipment amounted on balance to € 31.0 million in 2021. It was higher than in recent years (2020: € 25.3 million), partly due to the divestment of business premises held for sale in 2020. The investments in intangible assets related to development costs, patents, licenses, and software slightly increased to € 40.5 million in 2021 (2020: € 39.2 million). TKH spent € 0.5 million on acquisitions (2020: € 0.5 million). There were no divestments in 2021 (2020: € 21.2 million).

Solvency was stable at 42.5% (2020: 42.3%). Net bank borrowings fell by € 56.3 million from the level at year-end 2020 to € 205.4 million at year-end 2021. The net debt/EBITDA ratio, calculated according to TKH’s bank covenant, stood at 0.9, well within the financial ratio agreed with our banks.

At year-end 2021, TKH employed a total of 6,160 FTEs (2020: 5,704), with 376 of those as temporary employees (2020: 121 FTEs).

Developments per technology segment

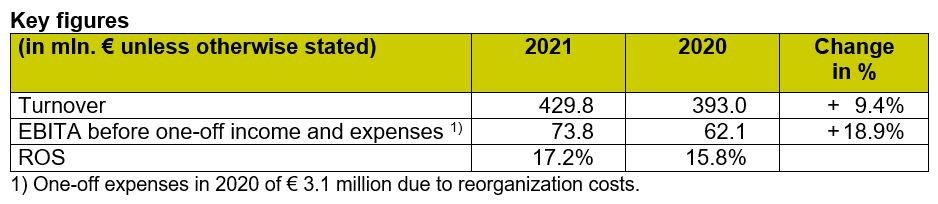

Smart Vision systems

TKH creates state-of-the-art Vision systems, and Vision technology represents about 86% of the turnover of the Smart Vision systems segment. This technology encompasses 2D and 3D Machine Vision and Security Vision systems. Combining these technologies with in-house software development allows us to create unique, smart, integrated plug-and-play systems, and one-stop-shop solutions.

In 2021, turnover in Smart Vision systems increased by 9.4% to € 429.8 million. Divestments executed in 2020 reduced turnover by 0.5%, and currency exchange rates had a negative impact of 0.6%. The organic growth in turnover was 10.5%, despite limitations in the supply of electronic components. The supply constraints slightly impacted turnover, although in most cases we managed to either secure most of the required components or redesigned our products to include components which were more widely available. The order book saw a growth of 91.1% compared to last year to € 139.3 million.

The added value decreased from 59.1% to 58.3%. Higher purchase prices on secured components had a negative impact on the added value as a percentage of turnover, but this was compensated by the volume growth. As a result, EBITA rose to € 73.8 million, resulting in a ROS of 17.2%.

Vision Technology – the strongest contributor to this segments’ growth in 2021 was Machine Vision, in all regions and end markets. We successfully maintained our leading market position in 3D Vision for the consumer electronics and wood industry, while we also significantly grew our business in the battery, logistics, and semiconductor markets. Within 2D Vision, the Alvium portfolio with embedded vision solutions is gaining traction and sales are growing.

Turnover growth for Security Vision was at a lower rate compared to Machine Vision due to low investment levels at parking garages, shopping malls, and airports, which continued to be impacted by COVID-19 restrictions. This however, was more than compensated for by growth in other markets. By securing our supply chain, we were able to meet this higher market demand. This was particularly applicable for (video) communication and traffic monitoring systems.

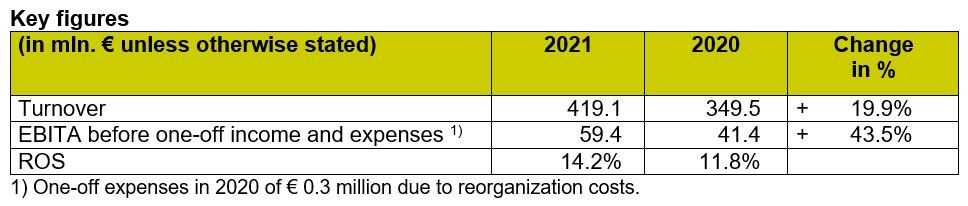

Smart Manufacturing systems

TKH leverages its unique expertise and deep understanding of automating production processes in specific industries to create superior manufacturing systems. TKH engineers complete manufacturing systems and machines that contribute to highly efficient processes. Tire Building systems represent about 68% of the Smart Manufacturing systems segment turnover share.

Turnover in Smart Manufacturing systems increased by 19.9% organically. Turnover grew from quarter to quarter in 2021 with a strong recovery, especially in Tire Building systems. Order book increased by 62.7% compared to the previous year-end and reached a high level of € 369.7 million on December 31, 2021.

The added value increased slightly from 48.7% to 49.0%.

EBITA was up 43.5% at € 59.4 million. The ROS improved to 14.2% due to high order intake and production output.

Tire Building – While turnover in Q1 was significantly impacted by the low order intake in Q2 and Q3 2020, there was a strong recovery leading to a record order intake in 2021 – broadly supported by intake from Asian customers as well as the tier 1 tire manufacturers. Market demand for both passenger and truck tire systems was high. Production capacity was swiftly scaled up to cope with the high order intake, which contributed to the strong improvement in results. The site acceptance of the UNIXX was delayed due to COVID-19, but the industrialization phase is progressing well. Several UNIXX modules have already been sold and successfully commissioned at customers sites. The commercial launch of the complete UNIXX platform is scheduled for 2022. Furthermore, we booked several orders for our new Revolute (combination of fully automated tire component preparation and bead assembly) and FLEXX belt maker.

Other – Turnover in Care grew at a high rate, driven by the roll-out of our INDIVION technology in North America, and our service organization in North America is scaling up to support further growth in this region. Turnover and growth in our results were also realized in industrial automation.

Smart Connectivity systems

TKH manufactures advanced Connectivity systems, and engineers complete Smart Connectivity systems with a unique, integrated system approach and sustainability proposition. Energy and Digitalization represent about 33% and 38% of the Smart Connectivity systems segment turnover share.

urnover in Smart Connectivity systems increased across almost all market segments by 22.4% to € 692.3 million in 2021. Higher raw material prices had an upward impact of 6.0% on turnover. On balance, turnover increased organically by 16.4%. Order intake was even higher with a growth of the order book with 85.3% to € 237.6 million compared to December 31, 2020.

Added value as a percentage of turnover decreased only slightly from 40.8% to 40.4% in 2021, although raw material prices went up during the year.

EBITA increased by 61.9% to € 73.2 million, due to turnover growth and higher production utilization. This resulted in an increase in ROS to 10.6%.

Energy – The strong demand for renewable energy sources and the expansion of the current network infrastructure are the main drivers of growth in our turnover. The extended production capacity for medium voltage energy cables became operational during the third quarter of 2021 and helped increase our production volumes. In subsea cable activities, production utilization increased significantly. The demand for Airfield Ground Lighting (CEDD/AGL) was significantly impacted by COVID-19, due to investment limitations at airports – however, the low order intake at airports was more than offset by growth in demand for energy connectivity systems.

Digitalization – Turnover increased due to high investment priority for fibre networks in Europe, and a reduced impact from lockdowns on clients’ installation capacities. We saw a particularly strong recovery in France and Germany. The impact on price levels from the overcapacity of optical fibre in China started to reduce in the second half of the year. Its impact on added value was offset by a higher share of our connectivity system portfolio. In the last quarter of 2021, the European Commission imposed anti-dumping duties on imports of optical fibre cables (OFC) from China into the European Union. However, the impact of this on our 2021 results was very limited.

Substantial growth was also realized in data network cable systems and broadband products for data centers and offices, especially in France and Germany.

Other – There was substantial growth in specialized connectivity systems for the machine-building and robotics industry. The building and construction market saw growth in the first half of the year, but stabilized in the second half due to limitations in supply and production capacity.

Outlook

The improved market circumstances for our technologies, combined with our capability to increase manufacturing capacity and utilization leads to a positive outlook for our business. Based on these developments, we anticipate further organic growth of turnover and result in 2022 in all segments.

Barring any unforeseen circumstances, such as a worsening of the current supply chain challenges, sustained disruption from COVID-19, or the geopolitical situation and conflict surrounding Ukraine and Russia, TKH expects the following developments per business segment in 2022.

Smart Vision systems

- Strong demand for 2D and 3D Machine Vision technologies is expected to continue into 2022, thanks to a combination of targeted programs in key markets and improved market conditions.

- For Security Vision, we expect the parking industry to recover gradually.

- We will increase investments in research & development and capacity expansion.

Smart Manufacturing systems

- Order intake for Tire Building technologies is expected to continue at a high level, driven by products such as the MAXX, MILEXX and Revolute. Additional investments in operational capacity will be executed to fulfill the anticipated demand.

- The turnover in care will grow further, driven by the successful launch and ramp-up of the INDIVION technology.

- In our other markets, mainly through our industrial automation systems, we expect growth to continue in 2022, facilitated by a production capacity expansion.

Smart Connectivity systems

- The demand in the energy infrastructure market continues to grow rapidly and as such we expanded our capacity for energy cables in the third quarter of 2021. On top of this, the order book is well filled, which will help to support a turnover increase in 2022.

- The turnover in digitalization is expected to increase, driven by rising fibre prices and the growing need for bandwidth in Europe.

- To respond to the high market demand, we have decided to prepare for an expansion of our production capacity and additional capital investments in 2022 and 2023.

As usual, TKH will provide a more specific profit forecast for the full year of 2022 at the presentation of its interim results in August 2022.

The complete press release can be downloaded in PDF.