H1 2023 Results

Press Release

Haaksbergen, the Netherlands

15 Aug 2023

Continued growth underpins strong strategic positioning

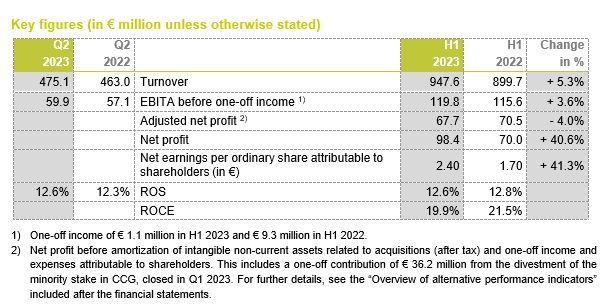

Financial highlights first half 2023

- Turnover increased by 5.3% to € 947.6 million (H1 2022: € 899.7 million). All segments contributed to the growth in turnover.

- Added value increased to 49.1% (H1 2022: 47.0%).

- EBITA before one-off income and expenses at € 119.8 million, up 3.6% (H1 2022: € 115.6 million), driven by EBITA growth at Smart Vision and Smart Connectivity systems; as expected, Smart Manufacturing systems recorded a decline in EBITA due to component shortages.

- Order book up 2.9% to € 999.9 million (December 31, 2022: € 971.9 million), strong growth in order book at Smart Manufacturing systems.

- ROS stable at 12.6% (H1 2022: 12.8%).

Strategic highlights first half 2023

- Solid progress in the further rollout of € 200 million Strategic Investment Program, with planned capacity expansions on schedule.

- Further progress in strategic positioning across all segments to benefit from favorable underlying megatrends.

- Acquisition of machine vision software designer and provider Euresys, announced divestment of connectivity distribution activities in France.

Outlook

For the full year 2023, assuming full-year contribution from connectivity distribution activities in France, TKH expects an EBITA before one-off income and expenses of between € 237 million and € 247 million (2022: € 234.8 million).

Alexander van der Lof, CEO of technology company TKH: “We continued to perform well in H1 2023 and managed to improve our added value across all segments as we strengthened our positioning. The demand for our technologies continues to grow, leading to further growth in turnover and EBITA for the group. We closed the half year with a record order book, mainly in Smart Manufacturing. We are seeing an easing of the supply chain issues of critical components at Smart Manufacturing, which has led to an improvement of Smart Manufacturing results during Q2, and we expect this trend to continue for the remainder of 2023. We also made good progress in reaching our ESG targets and see ESG as one of our main priorities.

We continue to focus on the execution of our Accelerate 2025 strategy. Our € 200 million Strategic Investment Program is progressing according to plan, with no delays in the construction of our capacity expansions. We acquired a leading high-tech machine vision software designer and provider, Euresys, and announced the divestment of our connectivity distribution activities in France, allowing us to put further strategic focus on our differentiating and innovative power in smart technologies to drive added value at higher levels.

We expect to continue to grow organically in H2 2023, largely driven by Smart Manufacturing. The market conditions for our 2D and 3D machine vision companies became more challenging during Q2 due to industry headwinds. The underlying market dynamics, however, remain strongly driven by automation, and we will continue to invest in strengthening our leading market positions. We will also continue to invest in strengthening our other core technologies to secure the longer term growth opportunities from the megatrends of automation, digitalization, and electrification.”

Strategic developments first half 2023

In 2022, we launched our Strategic Investment Program to further increase our global production capacity to meet growing market demand in the fields of automation, digitalization, and electrification. The execution of these expansions started in the second half of 2022 and is progressing on schedule.

- Onshore and offshore power cables – the € 150 million investment plans to meet the additional demand for onshore and offshore connectivity are progressing well.

- The expansion of our existing facilities in Lochem for the production of medium- and high-voltage cables is expected to become operational in phases starting in Q3 2023. We have been selected as one of the suppliers by system operator TenneT for the supply of high-voltage cables in the coming years.

- The construction of the new inter-array cable plant in Eemshaven is progressing according to plan, and serial production is expected to start in Q2 2024. Ørsted, the world leader in offshore wind power, awarded TKH a major contract for the supply and termination of nearly 200 kilometers of inter-array and other cables, with production starting in Q4 2023.

The current sales funnel for subsea cables is promising.

- Fibre optic cables: the new plant in Poland, which will increase our EU cabling capacity, eliminating the € 10 million of anti-dumping duties incurred in 2022, will be operational in Q3 2023.

- The new plant in Poland for specialized connectivity systems will be operational in Q3 2023.

- The additional capacity for Tire Building systems in Poland became operational in Q2 2023.

Of the total amount of € 200 million allocated for strategic investments, € 55 million was spent in H1 2023 and, together with the € 41 million in 2022, a total of € 96 million was spent.

In H1 2023, we made strong progress in our strategic positioning, as part of our Accelerate 2025 program:

- We made further inroads in our digital transformation, upscaling, upskilling and strengthening the management of our shared technology service center in Poland, and setting-up an Artificial Intelligence hub in Amsterdam.

- In Machine Vision, we further positioned the TKH Vision group as a one-stop-shop technology partner for customers, invested in expanding the sales organization, and are preparing to open additional Solution Centers for TKH Vision, besides the one in Konstanz.

- In H1 2023, we finalized the divestment of our minority share in CCG with a one-off profit of € 36.2 million.

- The acquisition of Euresys, a leading, innovative, high-tech designer and provider of software for 2D and 3D image analysis and video capture and processing, was completed on May 9. In 2022, Euresys realized an annual turnover of about € 27 million. TKH expects the acquisition to have a positive impact on TKH's earnings per share from 2023 onwards.

- On May 31, we announced the intended divestment of connectivity distribution activities in France, which includes the entities CAE Data and ID cables, for an enterprise value of € 118 million, to private equity company Argos Wityu SAS. Under the terms of the agreement, TKH will reinvest € 26.5 million to acquire a minority stake of 40% in the carve-out. The transaction is expected to be completed in Q3 2023, upon which a one-off net profit contribution of about € 20 million will be realized.

TKH continues to demonstrate a strong commitment to its ESG ambitions and made further progress in H1 2023 towards our key sustainability targets as set out in the Accelerate 2025 strategy program. We continued to reduce our net carbon footprint for scopes 1 and 2 in H1 2023, mainly through energy efficiency measures, a higher share of renewable energy, green certificates, and the ongoing transition of our fleet to electrical vehicles. The turnover related to the Sustainable Development Goals (SDG) stood at 69% (2022: 68%).

Financial highlights second quarter 2023

Turnover increased by 2.6% to € 475.1 million (Q2 2022: € 463.0 million). Adjusted for acquisitions and currency effects, turnover increased 2.1% organically, with price effects accounting for 3.2%. EBITA before one-off income increased by 4.9% to € 59.9 million (Q2 2022: € 57.1 million). Order intake in the second quarter reached € 470.8 million, and ROS amounted to 12.6 % (Q2 2022: 12.3%).

Financial developments first half 2023

Turnover in the first half of 2023 reached € 947.6 million, a 5.3% increase (H1 2022: € 899.7 million). Adjusted for acquisitions (+0.6%) and currency effects (-0.3%), turnover grew organically by 5.0%, with price effects accounting for 4.1% of turnover. All segments contributed to the organic growth in H1 2023, most notably Smart Connectivity systems. At Smart Vision systems, turnover in Q2 was negatively impacted by weaker market conditions and destocking by customers at Machine Vision.

The geographical distribution of turnover remained broadly in line with H1 2022. The turnover share in the Netherlands grew to 26% of total turnover (H1 2022: 24%), while the share in Europe, excluding the Netherlands, decreased slightly to 42% (H1 2022: 43%). In Asia, the share of turnover decreased to 16% (H1 2022: 18%), partly due to reshoring, while in North America turnover remained stable at 12% (H1 2022: 12%). The turnover share of the other geographical areas increased slightly to 4% (H1 2022: 3%).

The added value increased to 49.1% in the first half of 2023 (H1 2022: 47.0%) due the easing of supply chain constraints, combined with the effect of sales price increases implemented in this and previous periods. All segments increased their added value, in particular Smart Connectivity.

The order intake in the first half of 2023 continued to grow, resulting in an order intake of € 975.6 million (H 1 2022: € 955.9 million), and an order book at June 30, 2023 of € 999.9 million (December 31, 2022: € 971.9 million), an increase of 2.9%. The order book at Smart Manufacturing systems remained very strong at € 598.5 million (December 31, 2022: € 573.0 million), mainly driven by Tire Building systems, which benefitted from the effects of reshoring and the capex programs of tire manufacturers.

Operating expenses (excluding amortization and impairments) increased by 12.5% compared to the first half of last year. Exchange rates had a negative impact of 0.4%, whereas acquisitions had a positive effect of 0.5%. Personnel expenses increased by 12.1%, driven by the increase in headcount (by 532 FTEs in H1 2023, including the ramp-up of capacity related to strategic investments) and payroll increases.

EBITA (the operating result before amortization of intangible assets and one-off income and expenses) increased by 3.6 % to € 119.8 million in the first half of 2023, from € 115.6 million in H1 2022. In H1 2023, Smart Connectivity systems was the largest contributor to EBITA (43.4% of total).

ROS remained stable at 12.6% (H1 2022: 12.8%), with the EU anti-dumping duties on fibre optic cables, operational inefficiencies from the supply chain constraints at Tire Building systems, and weaker market conditions for the 2D and 3D machine vision companies all having a dampening effect on ROS. A one-off income of € 1.1 million was recorded in H1 2023 in relation to assets held for sale (H1 2022: one-off income of € 9.3 million).

Net interest expenses increased to € 8.9 million (H1 2022: € 3.4 million) due to higher interest rates combined with a higher outstanding debt. This was partly offset by lower foreign exchange losses. The result from associates of € 36.2 million relates to one-off contribution from the divestment of the remaining stake in CCG in Q1 2023.

The normalized effective tax rate decreased to 25.7% in the first half of 2023 from 26.3 % in H1 2022, primarily due to relatively higher profits at companies benefitting from R&D tax facilities.

Net profit before amortization and one-off income and expenses attributable to shareholders decreased by 4.0% to € 67.7 million (H1 2022: € 70.5 million) mainly due to higher interest expenses. Net profit, which includes the € 36.2 million one-off contribution from the divestment of a minority stake in CCG, increased by 40.6% to € 98.4 million (H1 2022: € 70.0 million).

Net interest-bearing debt, calculated in accordance with the bank covenants, increased by € 173.6 million from the level at year-end 2022 to € 480.8 million at June 30, 2023. Items which have affected the debt level are the increase in working capital (€ 101.2 million), net investments in property, plant and equipment of € 71.0 million (of which € 55 million is related to the strategic investment program), dividends paid (€ 67.5 million), acquisitions (€ 42.9 million) and investments in intangible assets (€ 25.5 million). Assets held for sale decreased by € 55.5 million. Cash flow from operating activities amounted to € 13.6 million (H1 2022: € -81.5 million) and improved due to lower working capital at June 30, 2023 (19.0% of turnover) compared to a year ago (20.4%). The net debt/EBITDA ratio stood at 1.7, well within the financial ratio agreed with our banks. Solvency decreased to 37.9% (H1 2022: 38.5%).

On June 30, 2023, TKH employed a total of 7,022 FTEs (June 30, 2022: 6,490 FTEs), of which 484 were temporary employees (H1 2022: 462 FTEs).

Developments by technology segment

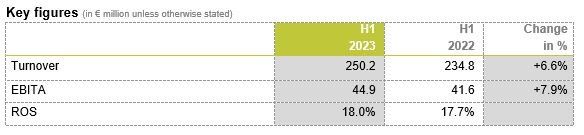

Smart Vision systems

TKH creates state-of-the-art vision systems, and vision technology accounts for about 87% of the turnover of the Smart Vision systems segment. This technology encompasses 2D and 3D Machine Vision and Security Vision systems. By combining these technologies with in-house software development, we create unique, smart, integrated plug-and-play systems and one-stop-shop solutions.

In H1 2023, the turnover of Smart Vision systems increased by 6.6% to € 250.2 million. Acquisitions had an upward impact of 2.1%. Adjusted for currency effects, turnover grew organically by 4.8%, with price effects accounting for 4.0% of turnover. The order book decreased to € 143.9 million (December 31, 2022: € 159.2 million). The added value increased from 58.1% to 59.6%. EBITA increased to € 44.9 million (+7.9%) and ROS improved to 18.0% (H1 2022: 17.7%).

Vision Technology – Security Vision turnover increased due to strong demand for security solutions for building applications and traffic monitoring systems. In Q2, the market conditions for both 2D and 3D Machine Vision weakened due to amongst others destocking at customers in a number of industries. The challenging operating environment for 2D and 3D machine vision companies is expected to continue.

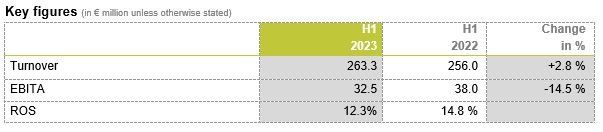

Smart Manufacturing systems

TKH leverages its unique expertise and deep understanding of automating production processes in specific industries to create superior manufacturing systems. TKH engineers complete manufacturing systems and machines that contribute to highly efficient processes. Tire Building systems account for 72% of the turnover in the Smart Manufacturing systems segment.

Adjusted for currency effects, turnover at Smart Manufacturing systems grew organically by 3.0%, with price effects amounting to 2.6%. The added value increased slightly from 48.7% to 49.5%. EBITA was down by 14.5% to € 32.5 million, while ROS decreased to 12.3% (H1 2022: 14.8%). Results in H1 2023 continued to be impacted by operational inefficiencies from delayed deliveries at Tire Building systems due to shortages of critical components. The order book grew by 4.5% and peaked at € 598.5 million (December 31, 2022: € 573.0 million), with a significant contribution from Tire Building systems.

Tire Building systems – Order intake remained at a high level for both passenger and truck tire systems. Added value improved due to the easing of supply chain issues as well as the impact of selling price increases and cost savings during the six-month period under review. With the improved availability of critical components, the field service is fully engaged in installing the backlog on-site. In Q2 2023, the expansion of the plant in Poland came on steam. Our breakthrough UNIXX technology continues to gain traction in various modules and applications.

Other – Growth was achieved in Care with the rollout and series production of INDIVION orders. Customer interest in this technology was converted into repeat orders.

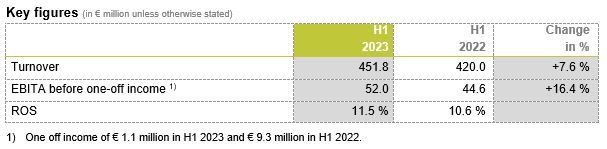

Smart Connectivity systems

TKH manufactures advanced connectivity systems, and engineers complete Smart Connectivity systems with a unique, integrated system approach and sustainability proposition. Energy and Digitalization account for about 38% and 34% of the turnover of the Smart Connectivity systems segment.

Turnover in Smart Connectivity systems increased by 7.6 % to € 451.8 million in H1 2023. Adjusted for currency effects, turnover grew organically by 7.8%, with price effects amounting to 5.1%. The order book grew to € 257.5 million (December 31, 2022: € 239.7 million). Added value as a percentage of turnover increased from 38.5% to 41.1% in H1 2023, due to a different product mix and price increases. EBITA increased significantly by 16.4% to € 52.0 million (H1 2022: € 44.6 million). ROS increased to 11.5%.

Energy – The demand for renewable energy sources and the expansion of the energy network infrastructure continued to drive turnover growth in energy connectivity in H1 2023. At the end of the period under review, order intake for onshore energy cables gradually weakened due to destocking by utility companies coupled with delays in electrification projects. Subsea systems were a major contributor to Energy’s turnover growth due to short lead times. Ørsted, the world leader in offshore wind power, awarded a major contract for the supply and termination of nearly 200 kilometers of inter-array and other cables, with production starting in Q4 2023.

Digitalization – Turnover was stable as the focus was on margin, leading to an improved result, despite the impact of the anti-dumping duties on imports of fibre optic cables from China into the EU totaling € 4.9 million in H1 2023. On August 1, 2023, the EU doubled the anti-dumping duties to 62%. The new plant in Poland will become operational in Q3 2023 and will eliminate the anti-dumping duties when fully operational.

Other – TKH’s specialized and customized connectivity systems for the machine-building, robotics, and medical industries continued to grow in H1 2023, with shorter lead times. The new plant in Poland for specialty cable will come on stream in Q3 2023.

Outlook

TKH expects the following developments per business segment:

Smart Vision systems

- Turnover and EBITA in H2 2023 are expected to grow compared to H1 2023, while the challenging market conditions may dampen this growth.

Smart Manufacturing systems

- Turnover and EBITA are expected to grow in H2 2023 compared to H1 2023, driven by the strong order book and the easing of supply chain constraints at Tire Building systems.

Smart Connectivity systems

- Turnover and EBITA in H2 2023 are expected to be lower than H1 2023 due to destocking and project delay effects of onshore energy cables, temporary underutilization of subsea in Q3 and higher anti-dumping duties (assuming a full-year contribution from cable connectivity distribution activities in France).

On balance and barring unforeseen circumstances, TKH expects EBITA before one-off income and expenses to be between € 237 million and € 247 million (2022: € 234.8 million), assuming a full-year contribution from the connectivity distribution activities in France, translating into a net profit before amortization and one-off income and expenses attributable to shareholders of between € 131 million and € 139 million (2022: € 143.5 million) for the full year 2023.

The presentation of the half year results on August 15, 2023 can be followed via live webcast at 10:00 CET (www.tkhgroup.com).

For further information:

Jacqueline Lenterman

Investor Relations

j.lenterman@tkhgroup.com

Tel: +31(0)53 5732901

Calendar

November 14, 2023 Trading Update Q3 2023

About TKH

The TKH Group is a leading technology company. We specialize in the development of innovative, client-centric systems that drive success in automation, digitalization, and electrification.

By integrating hardware, software, and customer-focused insight, our smart technologies provide unique answers to client challenges. In doing so, we work to make the world better by creating ever more efficient and more sustainable systems.

Our more than 7,000 employees drive sustainable growth in a culture of entrepreneurship, working closely with customers to create one-stop-shop, plug-and-play innovations for Smart Vision, Smart Manufacturing, and Smart Connectivity technology.

Listed on Euronext Amsterdam (TICKER: TWEKA), we operate globally and focus our growth across Europe, North America, and Asia.

For further information, please visit www.tkhgroup.com.

The complete press release can be downloaded in PDF.