Full year 2014 Results

Press Release

Haaksbergen, the Netherlands

10 Mar 2015

Succesful year for TKH

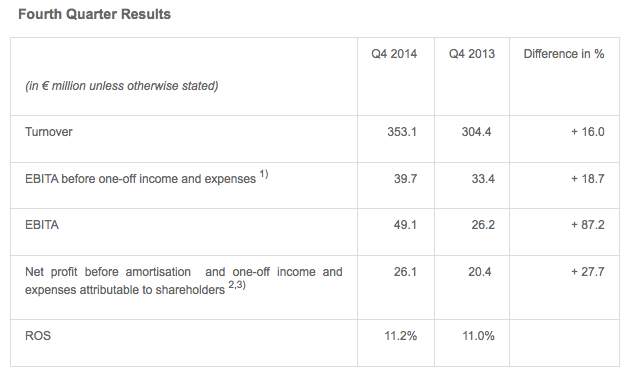

Highlights Q4

- Turnover up 16.0% at € 353.1 million, with growth almost entirely organic.

- Increase in turnover largest in Industrial Solutions, but also substantial turnover growth in Telecom and Building Solutions.

- Successful € 75 million share issue to finance further strategic growth.

- Acquisition of Commend group, effective as from January 2015.

- One-off income of € 9.4 million related to change in pension plans.

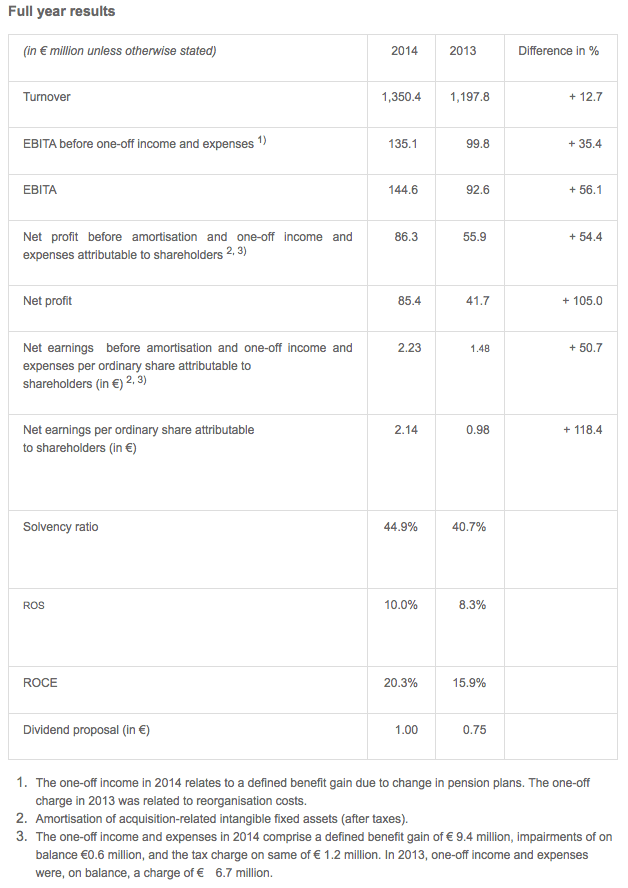

Highlights 2014

- Turnover up 12.7% at € 1.35 billion, with growth almost entirely organic, particularly large increase in turnover at Industrial Solutions.

- Order intake in tyre manufacturing segment at record level of almost € 400 million.

- Higher order intake at Building Solutions.

- Merger squeeze-out Augusta Technologie AG in completion stage.

- Increase in medium-term target ROS bandwidth to 10-11%.

- Innovations account for 22.8% of turnover.

- Dividend proposal € 1.00 per (depository receipt for an) ordinary share.

Alexander van der Lof, CEO of technology company TKH:

“The increase in turnover and profit can be considered extraordinary. It shows that we made the right strategic choices and this inspires us to continue on the same successful path. TKH’s technological basis is our strength and it is good to look back and see how we have managed to expand and strengthen this basis in recent years. Our clients challenge us to provide innovative technology or work with them to develop this technology. TKH has succeeded in providing added value in technologies that make processes more efficient and secure, with a high return on the investments for our customers. The scale we have realised in recent years has boosted the improvement in our margins. This has translated into a ROS of 10% in 2014, which has in turn inspired us to raise our ROS target for the coming years.”

Financial developments

In 2014, TKH’s turnover came in € 152.5 million higher (12.7%) at € 1,350.4 million (2013: € 1,197.8 million). Acquisitions contributed 0.5% to turnover. Reduced raw materials prices had a negative impact of 0.7% on turnover. Organic turnover growth was 12.9% on balance.

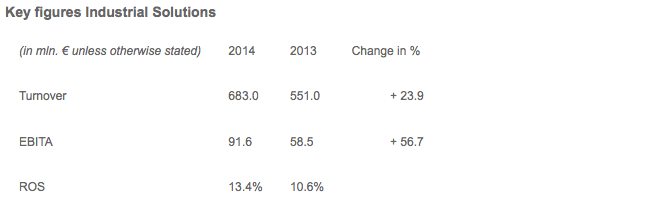

The strongest turnover growth, of 23.9%, was recorded by Industrial Solutions. Turnover at Telecom Solutions was up 5.4%, while turnover at Building Solutions came in 2.5% higher. For the full-year 2014, the contribution to turnover from Industrial Solutions increased to 51%, from 46% the previous year, while the contribution from Building Solutions declined to 37% from 41%. Telecom Solution’s contribution dropped to 12%, from 13% a year earlier. Innovations once again made a very positive contribution to turnover, accounting for 22.8% of turnover in 2014 (2013: 21.2%).

TKH saw gross margin increase to 42.6%, from 41.7% in 2013, thanks to an improvement in product mix. Operating costs (excluding one-off income and expenses) as a percentage of turnover declined to 32.6% in 2014, from 33.3% in 2013. Depreciation came in higher at € 19.9 million, up € 0.5 million compared to 2013, due to a higher level of investments in recent years.

The operating result before amortisation of intangible assets and one-off income and expenses (EBITA) came in 35.4% higher at € 135.1 million in 2014, compared with € 99.8 million in 2013. EBITA at Industrial Solutions was up 56.7%, and climbed 9.4% at Building Solutions. Telecom Solutions recorded a 2.0% increase in EBITA compared to 2013. The ROS increased to 10.0% (2013: 8.3%) and came in at the upper end of the ROS target TKH had previously communicated (bandwidth of 9-10%).

In the fourth quarter of 2014, various pension plans in the Netherlands were changed and harmonised in line with new pension legislation. TKH replaced these pension plans with a defined contribution plan, which are covered by a pension insurer. This eliminated future commitments and resulted in one-off income of € 9.4 million in 2014 (2013: one-off charge of € 7.2 million due to restructuring costs). EBITA, including one-off income and expenses, came in at € 51.9 million (56.1%) higher at € 144.6 million.

Amortisation increased by €1.1 million to € 26.2 million due to higher investments in research & development. TKH also recognised an impairment of net € 0.6 million.

In 2014, TKH saw financial expenses decline by € 4.8 million to € 10.4 million. The improvement was due to a one-off amortisation of capitalised financing costs in 2013 as a result of the renewed credit facility in October 2013, as well as reduced interest and lower credit spreads and the termination of interest rate swaps in 2014. Lower interest charges were offset by a lower result from participations, which in 2013 benefited from positive exchange rate effects.

The tax rate declined to 20.6% in 2014, from 22.5% in 2013. The application of the Dutch innovation box facility had a positive impact on the tax rate, thanks to the high share of innovations in the turnover of TKH and related profit.

Net profit before amortisation and one-off income and expenses attributable to shareholders was € 86.3 million in 2014 (2013: € 55.9 million), a year-on-year increase of 54.4%. Net profit for the full year 2014 came in higher at € 85.4 million (2013: € 41.7 million). Earnings per share before amortisation and one-off income and expenses came in at € 2.23 (2013: € 1.48). Ordinary earnings per share were € 2.14 (2013: € 0.98).

TKH recorded an increase in operational cash flow to € 94.9 million (2013: € 78.6 million). Working capital as a percentage of turnover increased slightly in 2014 to 13.8% (2013: 13.2%). Net investments in property and equipment came in at € 34.2 million in 2014 (2013: € 18.7 million). A large proportion of these expenditure were related to investments in TKH’s production facilities, including the expansion of capacity for the sub-segment manufacturing systems and fibre network systems. In addition, TKH invested € 22.5 million in intangible fixed assets, primarily in R&D, patents, licences and software (2013: € 16.8 million). Expenditure for acquisitions totalled € 6.8 million for GF Messtechnik GmbH (June 30, 2014) and the settlement of some option and earn-out arrangements. Furthermore, an additional interest in Augusta Technologie AG ("Augusta") was acquired from some minority shareholders for € 65.5 million.

TKH had reduced its net bank debt by € 20.8 million to € 164.8 million at year-end 2014 compared to the year-earlier period, partly due to the issuance of 3,061,225 (depository receipts for) ordinary shares in November 2014. The net proceeds from the share issue amounted to € 74.1 million and these proceeds are being used to finance the acquisition of Commend, the squeeze-out of the Augusta minority shareholders, investments and for general operating purposes. The share issue and the net result realised raised the solvency ratio to 44.9% in 2014 (2013: 40.7%). TKH is operating well within the financial ratios agreed with its banks. The net debt/EBITDA ratio stood at 1.0 and the interest coverage ratio at 18.9.

TKH had a total workforce (FTEs) of 5,030 at year-end 2014 (2013: 4,802) and employed a further 483 (FTEs) temporary employees at year-end 2014. The increase in the number of staff was largely due to the strong increase in activity at Industrial Solutions and additional hires to bolster the organisation on the R&D and commerce fronts at Building Solutions.

Progress in realisation targets and strategy

The growth in turnover and profit was largely driven by TKH Group’s technological developments in recent years and the company’s focus on the four core technologies - vision & security, communication, connectivity and manufacturing systems – combined with the seven vertical growth markets - optical fibre networks, parking, tunnels & infra, healthcare, marine, oil & gas, industrial machine vision and tyre manufacturing.

In 2014, we took a major step towards realising our ambition to increase turnover from the 2012 figure of € 450 million in the vertical markets by some € 300 to € 500 million in three to five years, following the growth of € 185 million realised in these markets in 2014. More than € 140 million of this growth came from the tyre manufacturing market. TKH also booked solid progress in the other vertical markets. This translated partly into an increase in turnover, which came from the realisation of some leading projects. In addition, TKH invested in technological development and bolstered the commercial organisation to realise its medium-term growth target.

As a result of the above, TKH expects turnover to grow by € 300 to € 500 million in the next three to five years in the seven vertical growth markets the group has defined.

Partly due to the higher margins realised in the vertical growth markets, TKH realised both its ROS and ROCE targets in 2014. The ROS came in at 10% (2013: 8.3%), which is at the upper end of the target bandwidth of 9-10%. The ROCE, at 20.3%, (2013: 15.9%) was also at the upper end of the target bandwidth of 18-20%. On the basis of the perspective offered by the vertical growth market strategy combined with benefits of scale, TKH has decided to increase its ROS target to a bandwidth of 10-11% for the medium term.

The innovation component in TKH’s turnover remained high at 22.8% in 2014 and was once again well above TKH’s target of generating 15% of its turnover from innovations launched on the market over the past two years. Innovations also helped TKH to increase its market share in 2014.

Change in segmentation

Effective 1 January 2015, TKH Group has simplified the segmentation of its operations. Due to the increased focus introduced in recent years, TKH has decided to integrate the Telecom Solutions sub-segment copper networks – which generates just 1.2% of turnover - in the sub-segment indoor telecom systems, due the limited size of the copper networks operation. Within Building Solutions, TKH Group has decided to integrate the sub-segment building technologies, with a turnover share of 6.7%, into the other two sub-segments: vision & security systems (30%) and connectivity systems (70%). These moves complete a process of simplification to bring the organisation more in line TKH’s technological focus in recent years, and have reduced the number of sub-segments to six.

Developments per solutions segment

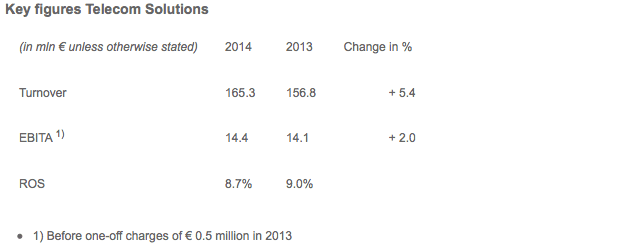

Telecom Solutions

Profile

Telecom Solutions develops, produces and supplies systems ranging from basic outdoor infrastructure for telecom and CATV networks through to indoor home networking applications. The focus of the business is on the delivery of completely worry-free systems for its clients, thanks to the system guarantees it provides. Around 40% of the portfolio consists of hub-to-hub optical fibre and copper cable systems. The remaining 60%, consisting of components and systems in the field of connectivity and peripherals, is deployed primarily in the network hubs.

Turnover in the Telecom Solutions segment increased by 5.4% to € 165.3 million. Turnover was up 14.6% in the fourth quarter, largely due to higher turnover in the fibre network systems segment. The main driver of the increase in turnover in the fourth quarter was an increase in demand for optical fibre networks in Europe. This was due to the fact that telecom operators had more budget available for investments after completing their heavy investments in 4G networks.

EBITA in the Telecom Solutions segment came in € 0.3 million higher. The ROS dropped slightly to 8.7%, from 9.0%, due to an increase in the contribution from activities in Poland, Germany and France, where TKH invested in the expansion of its strategic position in anticipation of expected growth opportunities in these countries. The margin in the second half of the year was in line with the year-earlier period, which in turn meant that the result in the second half of 2014 was higher than in the first half of the year.

Indoor telecom systems - home networking-systems, broadband connectivity, IPTV software solutions – turnover share 4.1%

Turnover at indoor telecom systems increased by 14.8% on the back of an increase in projects to upgrade broadband connections in the Benelux region. TKH Group saw higher demand for broadband capacity in homes, which resulted in replacement demand for broadband connectivity components with improved transmission properties and a higher broadband capacity.

Fibre network systems - optical fibre, optical fibre cables, connectivity systems and components, active peripherals – turnover share 6.9%

Turnover came in 10.1% higher. Investments in Europe once again increased in the course of the year, as most telecom operators completed their 4G network investments in the first half of the year. We made full use of the extra production capacity for optical fibre we added in 2013, while production and efficiency improvements also helped to strengthen our competitive position. In Poland, Germany and France in particular, a number of strategic projects were acquired which put pressure on margins. These projects did help TKH Group to establish the foothold that is crucial given the growth potential of those countries. Demand in China also increased in the second half of the year. TKH decided to replace its existing outdated production capacity with the advanced production technology introduced in 2013, which also led to an expansion of production capacity. This project is expected to be completed at the end of the first quarter of 2015.

Copper network systems – copper cable, connectivity systems and components, active peripherals – turnover share 1.2%

Turnover in this segment fell by 30.3%, in line with the shift in investments towards optical fibre networks and 4G networks. As of 1 January 2015, due to its modest size this sub-segment has been integrated in the sub-segment indoor telecom systems.

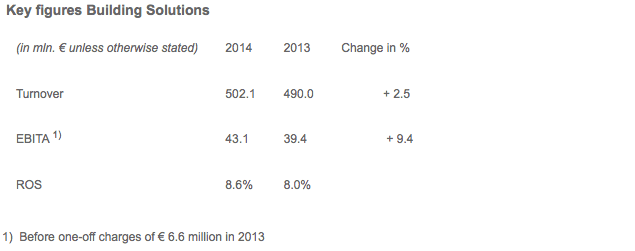

Building Solutions

Profile

Building Solutions develops, produces and delivers solutions in the field of efficient electro-technical technology, ranging from applications within buildings to technical systems which, linked to software, provide efficiency solutions for the care and security sectors. TKH’s know-how in this segment is focused on vision technology and connectivity systems combined with efficiency solutions to reduce the throughput-time for the realisation of installations within buildings and industrial automation. In addition, TKH’s focus in this segment is on intelligent video, intercom and access monitoring systems for a number of specific sectors, including elderly care, parking, marine, oil & gas, tunnels and security for buildings and work sites.

Turnover in the Building Solutions segment increased by 2.5% to € 502.1 million. Acquisitions accounted for growth of 1.1%. Organic growth, corrected for the effect of lower raw materials prices, came in at 2.2%. The market conditions were challenging, especially in the Benelux region, due to the lack of recovery in the building and construction sector. Turnover declined in the first nine months of the year. The focus on the vertical growth markets and continued internationalisation led to organic growth of 8.3% in this segment in the fourth quarter. The largest contribution to this growth came from the sub-segment vision & security systems, which recorded organic of 13.4%. Order intake in Building Solutions was up due to an increase in larger-scale projects with a value of € 1 million to € 5 million.

EBITA in this segment increased by 9.4% to € 43.1 million. The margin in the sub-segment connectivity did come under pressure but higher turnover in the other sub-segments and the efficiency drives TKH had initiated resulted in an increase in the result. The ROS from this segment climbed to 8.6% in 2014, from 8.0% in 2013, largely due to the higher contribution to turnover from vision & security systems.

Building technologies – energy-saving light and light switch systems, energy management systems, care systems, structured cabling systems – turnover share 6.7%

Turnover at building technologies was 4.0% higher in 2014, largely due to positive developments in the vertical growth markets parking and tunnels & infra. TKH won key projects for parking systems in Australia, North America and the Middle East, all of which were delivered in the fourth quarter of last year. This led to a stronger rise in turnover in the final quarter than in the preceding quarters. Turnover in the healthcare market came in lower due to a reluctance to invest in the Dutch healthcare sector. Effective 1 January 2015, TKH merged this sub-segment with the two other sub-segments vision & security systems and connectivity systems.

Vision & Security systems – Vision technology, systems for CCTV, video/audio analysis and detection, intercom, access control and registration, central control room integration – turnover share 18.8%

Turnover came in 8.3% higher. Turnover rose in the course of the year, culminating in a 15.3% increase in the fourth quarter, largely due to the focus on vertical growth markets. The innovations and distinctive technologies in this segment are an excellent response to the need among our customers to work more securely and efficiently. The increasing threat of terrorist attacks around the world is creating a demand for ever more advanced security systems. This trend is having a positive impact on turnover growth in this segment. The share of turnover generated outside the Netherlands increased sharply, thanks to the large number of international projects completed. This also enabled TKH to offset the impact of the continued reluctance to invest in the building and construction sector. TKH increased its R&D spending to increase the competitive edge its technology gives it in this market.

Connectivity systems – specialty cable (systems) for shipping, rail, infrastructure, wind energy, as well as installation and energy cable for niche markets – turnover share 11.7%

Turnover at connectivity systems fell by 6.4%, due to challenging market conditions in the building and construction sector in the Benelux region, where TKH generates the majority of its turnover in this segment. Lower raw materials prices had a negative impact of 2.5% on turnover, as did lower investment levels in the energy and network sector in the Netherlands. TKH was able to limit the drop in turnover in the fourth quarter to 0.4%, thanks to a more effective international market positioning and focus on the defined vertical growth markets marine, oil & gas and tunnels & infra. Margins did come under pressure, but improved on the back of the efficiency programmes TKH initiated.

Industrial Solutions

Profile

Industrial Solutions develops, produces and delivers solutions ranging from specialty cable, plug and play cable systems to integrated systems for the production of car and truck tyres. The company’s know-how in the automation of production processes and improvements in the reliability of production systems gives TKH the differentiating potential to respond to the increasing desire to outsource the construction of production systems or modules in a number of specialised industrial sectors, such as tyre manufacturing, robotics, medical and machine construction industries.

Turnover in the Industrial Solutions segment came in 23.9% higher at € 683.0 million. Lower raw materials prices had a negative impact of 0.7% on turnover. Turnover increased by 24.6% organically. The main driver of turnover growth in this segment was the substantial growth realised in the tyre manufacturing industry, with particularly strong growth in Asia.

EBITA was up 56.7% at € 91.6 million. Thanks to effective costs controls, the strong rise in turnover and a high proportion of new technology with higher margins, EBITA increased more strongly than turnover. TKH was able to spread capacity utilisation across the various production facilities more evenly than in previous years, which in turn boosted the increase in the ROS. As a result, the ROS climbed to 13.4% from 10.6%.

Connectivity systems – specialty cable systems and modules for the medical, robot, automotive and machine building industries – turnover share 17.9%

Turnover at connectivity systems was up 1.6%, corrected for the negative impact of 1.4% on turnover due lower raw materials prices passed on to customers. The uncertain economic climate in Europe led to a certain amount of reluctance to invest at a number of clients, which kept growth modest. Margins did improve due to a higher proportion of innovative solutions for medical equipment. The fact that cable systems also accounted for a higher proportion of turnover also boosted margins. TKH also expects complete systems to account for an ever greater proportion of turnover in this segment in the years ahead, with integrated cable chain systems accounting for a growing share of the turnover in this sub-segment.

Manufacturing systems – advanced manufacturing systems for the production of car and truck tyres, can washers, test equipment, product handling systems for the medical industry, machine operating systems – turnover share 32.7%

Turnover at manufacturing systems increased by 42.4%. It is worth noting that the turnover, which has been growing extremely quickly and 100% organically since 2013, was booked at very high efficiency levels, after some teething problems in 2013. TKH had to lease extra space in both the Netherlands and China to create sufficient capacity. The number of hired-in staff was also extremely high last year. Thanks to solid cost controls and the high levels of efficiency, EBITA increased more than turnover and margins came in higher than in the previous year.

The share of new technology in both turnover and order intake was high at 46.6%. Thanks to the advanced nature of the new technology, TKH managed to accelerate the replacement of existing production capacity at the company’s clients in the tyre manufacturing industry. This acceleration was particularly marked in Asia, where investments in the expansion of production capacity also boosted growth. The order intake for the full year came in at almost € 400 million, a new record for TKH. The order intake in the second half of the year was slightly lower than in the first half, due to the fact that investments in Asia slowed in comparison with the extreme demand seen in the first half of the year. Turnover and order intake from the top-five tyre manufacturers increased in line with demand from other clients.

TKH took a major step forward in this segment, with the development of the next generation of tyre manufacturing technology, which not only assembles the tyre but also incorporates the production of the components used in the tyre in a single system. TKH plans to launch this system under the brand name UNIXX within the next three years. The market price of this new integrated system is expected to be three times more than the current systems.

Events after the balance sheet date

As announced on 20 November 2014, TKH reached agreement with the shareholders of Commend on the acquisition of a controlling interest in the Commend group, which is based in Salzburg (Austria). The shares in Commend were transferred in January 2015. Commend books annual turnover around € 45 million with a workforce of more than 300 employees. The company’s activities will strengthen TKH’s sub-segment vision & security systems and will contribute to the profitability of the Building Solutions segment.

On 17 November of last year, TKH confirmed, as part of the squeeze-out procedure, its decision to start this procedure to obtain the remaining shares held by the minority shareholders in Augusta Technologie AG ("Augusta"). TKH holds 91.2% of the shares in Augusta. The merger squeeze-out was approved by the Augusta shareholders meeting. TKH expects the merger squeeze-out to come into force in March 2015.

Proposed reappointment Executive Board

The Supervisory Board announces the proposed reappointment of Arne Dehn for a following term of four years as a member of the TKH Group N.V. Executive Board effective from the Annual General Meeting of 7 May 2015.

Dividend proposal

At the Annual General Meeting to be held on 7 May 2015, TKH will propose the payment of a dividend of € 1.00 per (depositary receipt for a) share (2013: € 0.75). Based on the weighted average outstanding shares, this amounts to a pay-out ratio of 44.8% of the net profit before amortisation and one-off income and expenses, and 46.7% of the net profit. Based on the outstanding shares at the end of 2014, the pay-out ratio amounts to 48.0% of the net profit before amortisation and one-off income and expenses and 50.0% of the net profit. TKH will propose the payment of an optional dividend in cash or in shares, which will be charged to the reserves. TKH will determine the dividend payment in shares one day after the end of the optional period on the basis of the average price of TKH shares during the last five trading days of the optional period, which shall end on 27 May 2015. The dividend will be payable, in cash or in shares, on 1 June 2015.

Outlook

There are signs of a cautious recovery in global economic conditions. The unstable geopolitical situation and the monetary situation still results in uncertainty about future economic developments.

We see opportunities and challenges in each Solutions segment. What is important is that we are positive on the medium to long-term outlook and that TKH’s core technologies are well positioned to realise continued growth. As a result of this, we expect turnover to grow by € 300 to € 500 million in the next three to five years in our seven defined vertical growth markets.

We expect, barring unforeseen circumstances, the following developments in 2015:

Telecom Solutions

We expect the market for optical fibre networks to grow. The penetration level for optical fibre is still low in most European countries and optical fibre technology is seen as the superior broadband technology. TKH has a solid position in the European market and we expect to see growth in this region. In addition to this, the Asian market is also a growth market, and TKH has a solid presence in this region. The increase in the value of Asian currencies will put some pressure on margins for the components purchased in Asia. To offset this, TKH will be taking additional steps to improve efficiency in the production process, and this will reduce cost prices.

Building Solutions

TKH expects the conditions in the building and construction sector in the Benelux region to remain challenging due to lack of recovery in this sector. However, the vertical growth markets, primarily those linked to TKH’s vision and security technology, are promising enough to assume growth can be booked in the Building Solutions segment.

Industrial Solutions

In the last few months, we have seen a slight reluctance to invest in capital goods in Asia. This is partly due to the recent explosive growth realised in the region. It is also partly due to uncertainty regarding the impact that potential import duties in the United States will have on Chinese tyre manufacturers. At the same time, there are encouraging signs of a pick-up in investments in efficiency improvements at the larger tyre manufacturers, which could increase demand for TKH technology. The robotisation trend is having a positive impact on the whole Industrial Solutions segment.

As usual, TKH will give a specific forecast on the full year profit for 2015 at the presentation of its interim results in August 2015.

The complete press release and presentation can be downloaded in PDF